Introduction

As we journey through life, we accumulate responsibilities, experiences, and memories. However, it’s also crucial to consider the financial aspects, especially when planning for the inevitable end of life. For senior citizens, ensuring financial security during this stage becomes paramount. In this article, we go deep into the significance of final expense insurance, shedding light on how it offers peace of mind and stability during a critical period. As individuals age, their financial priorities and requirements evolve. Senior citizens often face the challenge of managing healthcare costs, daily expenses, and planning for their legacy. Final expense insurance aims to alleviate the burden associated with end-of-life arrangements, providing a safety net for both the policyholder and their family members.

Table of Contents:

What is Final Expense Insurance?

Final cost insurance, also known as funeral insurance or burial insurance, is a type of health insurance designed to cover expenses related to funeral, burial, or cremation when a person dies.

Unlike traditional life insurance, terminal health insurance typically offers lower premiums, ranging from a few thousand dollars to tens of thousands of dollars. The insurance pays immediately when the secretary dies, ensuring that his or her loved ones do not experience financial difficulties during difficult times.

Importance of Final Expense Insurance for Senior Citizens

One of the most important benefits of end-of-life insurance is the financial security it provides to seniors and their families. By purchasing a policy, people can be confident that their end-of-life expenses will be covered and that their loved ones will have their funeral expenses, medical expenses, and other expenses covered. In addition to financial protection, final payment insurance also provides peace of mind to policyholders and their families. Knowing that arrangements have been made and bills will be paid, people can focus on spending quality time with their loved ones rather than worrying about their finances after death.

How Final Expense Insurance Works

Final expense insurance operates similarly to traditional life insurance policies, with some key differences tailored to meet the specific needs of seniors.

Premiums and Payouts

Policyholders pay regular premiums to manage their coverage, which can be adjusted to suit their budgets and preferences. If the insured dies, the insurance company gives the payment to the beneficiary; this person can use the money to cover funeral expenses and other final expenses of life.

No Medical Exam Policies

Most final settlement insurance offers a simple accounting process that eliminates the need for serious medical examinations or health checks. This flexibility makes final payment insurance a good choice for seniors who have health problems or are concerned about whether they are covered.

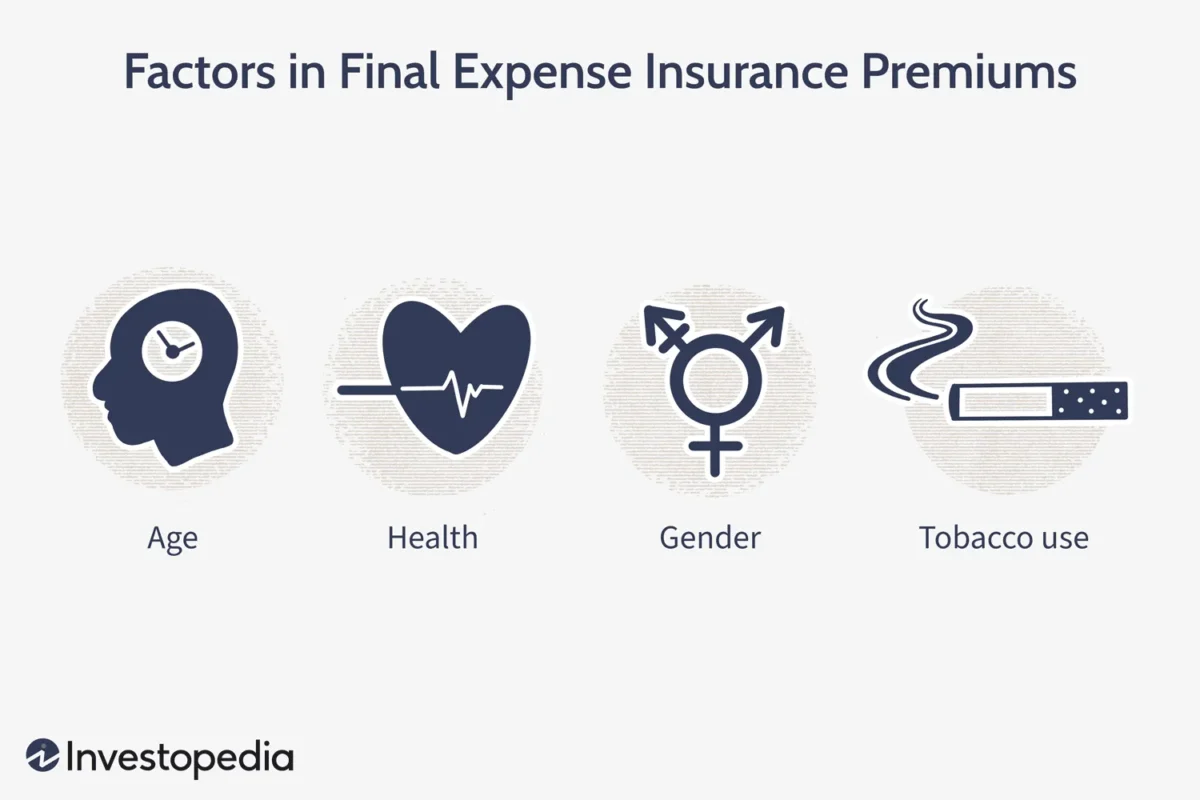

Eligibility Criteria for Final Expense Insurance

Final expense insurance policies typically have lenient eligibility criteria, making them accessible to a wide range of individuals, including seniors and those with underlying health issues. In most cases, applicants must meet age requirements and disclose basic medical information to qualify for coverage.

Benefits of Final Expense Insurance

Burial Costs Coverage

One of the primary benefits of final expense insurance is its ability to cover burial and funeral expenses, including caskets, urns, burial plots, and memorial services. This ensures that the policyholder’s final wishes are honored without placing a financial burden on their loved ones.

Debt Settlement

Final expense insurance can also be used to settle outstanding debts, such as medical bills, credit card debt, or mortgage payments, ensuring that the policyholder’s estate is not encumbered by financial liabilities upon their passing.

Conclusion

In conclusion, final expense insurance serves as a valuable tool for senior citizens to achieve financial security and peace of mind during the end-of-life planning process. By understanding the importance of final expense insurance, seniors can make informed decisions to protect themselves and their loved ones from the financial burden of funeral expenses and other end-of-life costs.

FAQs

1. What is the difference between final expense insurance and traditional life insurance?

Ans-Final expense insurance offers smaller coverage amounts specifically designed to cover end-of-life expenses, while traditional life insurance policies provide broader coverage for long-term financial needs.

2. Are there age restrictions for purchasing final expense insurance?

Ans-While eligibility requirements vary by insurer, many final expense insurance policies are available to individuals up to a certain age, typically ranging from 50 to 85 years old.

3. Can I purchase final expense insurance for a family member?

Ans-Yes, individuals can purchase final expense insurance policies for themselves or as beneficiaries on behalf of a family member.

4. Are final expense insurance premiums tax-deductible?

Ans-In most cases, final expense insurance premiums are not tax-deductible. However, it’s essential to consult with a tax advisor to understand the specific tax implications based on individual circumstances.