For people who live in rented accommodations, having renters insurance is a wise decision. This type of insurance can provide a safety net in case any unexpected events, such as theft or damage, occur to your personal belongings. Whether you live in an apartment, condo, or house, renters insurance can give you the peace of mind that comes with knowing that you’re financially protected. However, it’s important to understand what exactly renters insurance covers and what it doesn’t, so you can decide whether it’s the right choice for you.

Table of Contents:

What Is Renters Insurance Coverage?

Renters insurance, which is also commonly referred to as tenants’ insurance, is a type of insurance policy that is designed to provide coverage for renters in case of unexpected events. It is important to note that while your landlord’s insurance policy may cover the physical dwelling, it does not provide coverage for your personal belongings. This is where renters insurance comes into play, as it is a form of property insurance that offers protection for a policyholder’s belongings, liabilities, and even living expenses in the event of a loss event. Therefore, it is highly recommended for renters to invest in a renters insurance policy to ensure that they are adequately protected from any unforeseen circumstances that may arise.

Best Home Healthcare Insurance

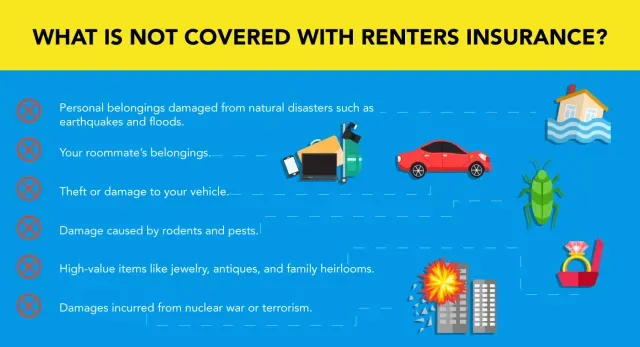

It’s important to note that renters insurance does not cover everything. Certain natural disasters, high-value items, and your roommate’s belongings may not be covered unless specified in your policy. Always read your policy carefully and discuss any questions or concerns with your insurance agent.

What’s Covered in Renters Insurance Coverage?

1. Personal Belongings

In case you happen to face unfortunate incidents such as fire, natural calamities or robbery that cause damage or theft of your personal belongings, renters insurance can come to your rescue. This type of insurance policy provides coverage for a wide range of items that are considered personal belongings, including but not limited to clothes, furniture, electronics and valuables. So, you can have peace of mind knowing that your possessions are protected in the event of any unforeseen circumstances.

Renters insurance not only covers you financially in case of theft, fire, or other unfortunate events in your rented home, but it also provides liability coverage in case someone gets injured or their property is damaged due to your negligence. This means that if a guest or visitor gets hurt while in your rented home, or their personal belongings get damaged, you won’t have to worry about being held financially responsible for their medical bills or repair costs. Additionally, renters insurance may also cover legal expenses that may arise from such incidents, giving you peace of mind knowing that you are protected from unforeseen events that may occur in your rented home.

3. Additional Living Expenses

In case of an unforeseen incident like a fire or any other unfortunate event that renders your rented home uninhabitable, you may find yourself having to find temporary accommodation. However, with renters insurance, you can rest assured that the cost of such temporary accommodation will be covered. This means you don’t have to worry about the financial burden of finding a new place to stay while your rented home is being repaired or rebuilt. Your renter’s insurance policy will provide the much-needed assistance to ensure you can find a safe and comfortable temporary home without worrying about the expenses involved.

Why Renters Insurance is Vital for College Students

4. Travel Protection

When you’re travelling, it’s important to ensure that your valuable possessions are protected from unforeseen circumstances that may arise. Luckily, renters insurance can help extend coverage to your personal belongings even when you’re away from home. This means that you can enjoy your trip with peace of mind, knowing that you’re financially protected in case your belongings are damaged, stolen, or lost while you’re on the go. With the right renter’s insurance policy, you can rest assured that you have the protection you need to fully enjoy your travel experience.

5. Medical Payments to Others

It covers the medical expenses of a guest who may get injured while visiting your place. This coverage applies regardless of who is at fault for the accident. So, if you have renters insurance, you can have peace of mind knowing that if a guest does get injured while at your place, their medical expenses will be taken care of.

What’s Not Covered Renters Insurance Coverage?

1. Structural Damage

It is important to note that while renters insurance provides coverage for various unfortunate events, such as theft or fire, it does not extend to any structural damage that may occur to the building or property itself. In such cases, it is the landlord or property owner’s responsibility to address and take care of any necessary repairs or renovations. Thus, it is essential to clarify and understand the specific terms and limitations of your renters insurance policy, to ensure that you have adequate coverage for any unexpected incidents that may arise.

2. Floods and Earthquakes

Standard renters insurance policies often don’t provide coverage for damages caused by floods and earthquakes. This means that if you reside in an area that is more susceptible to these natural disasters, it’s highly recommended that you consider purchasing separate policies that specifically cover these types of events. Doing so can help ensure that you are adequately protected and prepared in the event of a flood or earthquake, with less worry about the potential costs of damage and repairs.

3. High-Value Items

Renters insurance is a great way to protect your personal property in case of unforeseen events. However, it’s worth noting that there are limits to the coverage provided for high-value items such as fine art, collectables, and expensive jewellery. This means that if you own any of these items, you may not be fully covered by your renter’s insurance policy. In such cases, you may need to consider getting additional coverage, also known as endorsements, to ensure that your high-value items are adequately protected in case of damage or loss.

4. Intentional Damage

It’s essential to remember that if you intentionally cause damage to your personal belongings or rented property, your renter’s insurance will not cover the costs of repair or replacement. This means that any damage that is done on purpose, whether it’s accidental or not, will not be covered by your policy. It’s important to be aware of this exclusion and take steps to prevent intentional damage to your property to avoid any financial losses in case of an incident.

Conclusion

In conclusion, renters insurance provides valuable protection for tenants in case of unexpected events such as theft or damage to personal belongings. It is important to understand what renters insurance covers and what it doesn’t before investing in a policy. While renters insurance offers coverage for personal belongings, liabilities, and living expenses, it does not cover everything, including structural damage. Therefore, it is important to read your policy carefully and discuss any questions or concerns with your insurance agent to ensure that you have adequate coverage and peace of mind. With the right renters insurance policy, you can protect yourself from unforeseen circumstances and enjoy your rented home with confidence.

FAQs

Q1. What is the average cost of renters insurance?

The average cost of renters insurance varies depending on several factors such as the state you live in, the amount of coverage you require, and your deductible. However, on average, renters insurance costs around $15-$20 per month.

Q2. Is renters insurance mandatory?

Renters insurance is not mandatory by law, but some landlords may require you to have it as a condition of your lease agreement. Even if your landlord doesn’t require it, it’s still a smart idea to invest in renters insurance to protect your personal belongings.

Q3. How much coverage do I need for renters insurance?

The amount of coverage you need for renters insurance depends on the value of your personal belongings. It’s recommended that you create a home inventory and estimate the total value of your possessions, then choose a coverage amount that will adequately protect those items.

Q4. What is the difference between replacement cost and actual cash value?

Replacement cost refers to the amount it would cost to replace your lost or damaged possessions with new ones of similar kind and quality. Actual cash value takes into account the depreciation of your belongings over time and pays out the value of your possessions at the time of loss. Replacement cost coverage is typically more expensive but provides more comprehensive coverage.

Q5. Can I bundle renters insurance with other insurance policies?

Yes, many insurance companies offer bundle discounts if you purchase multiple insurance policies from them. You can often bundle renters insurance with auto insurance or other types of coverage to save money on your overall insurance costs.